the Creative Commons Attribution 4.0 License.

the Creative Commons Attribution 4.0 License.

GC Insights: Open-access R code for translating the co-occurrence of natural hazards into impact on joint financial risk

Adrian Champion

Tom Perkins

Freya Garry

Hannah Bloomfield

Hydro-meteorological hazard is often estimated by academic and public sector researchers using publicly funded climate models, whilst the ensuing risk quantification uses proprietary insurance sector models, which can inhibit the effective translation of risk-related environmental science into modified practice or policy. For co-occurring hazards, this work proposes as an interim solution an open-access R code that deploys a metric (i.e. inter-hazard correlation coefficient, r) obtainable from scientific research that is usable in practice without restricted data (climate or risk) being exposed. This tool is evaluated for a worked example that estimates the impact on joint financial risk at an annual 1-in-200-year level of wet and windy weather in the UK co-occurring rather than being independent, but the approach can be applied to other multi-hazards in various sectors (e.g. road, rail and telecommunications) now or in future climates.

- Article

(939 KB) - Full-text XML

-

Supplement

(4892 KB) - BibTeX

- EndNote

The works published in this journal are distributed under the Creative Commons Attribution 4.0 License. This license does not affect the Crown copyright work, which is re-usable under the Open Government Licence (OGL). The Creative Commons Attribution 4.0 License and the OGL are interoperable and do not conflict with, reduce or limit each other.

© Crown copyright 2024

Translating scientific work into improved policy or practice is widely accepted to be desirable yet challenging (Cordner, 2015; Dowling, 2015; Evans, 2006; Margalida et al., 2015; Scott et al., 2018). For hydro-meteorological natural hazards such as flooding or wildfire (Berghuijs et al., 2019; Finney et al., 2011) caused by extreme weather, two main restrictions on data inhibit the effective translation of risk-related environmental science into modified practice in the insurance sector (e.g. Hillier and Van Meeteren, 2024). Firstly, the open-access dataset output by each publicly funded weather and climate model (e.g. from Met Office and ECMWF) is large (tens of terabytes), with users required to have the capability to translate the variables provided into metrics related to extremes. Data might also be released to academics on non-commercial licenses. Secondly, financial risk is quantified using proprietary models and sensitive data (e.g. insurance claims).

During February 2022, the storm sequence Dudley, Eunice and Franklin inflicted several hydro-meteorological hazards (snow, landslips, flooding and extreme winds) across the UK and northwest Europe (Mühr et al., 2022; Volonté et al., 2024a, b), resulting in multi-sector impacts (e.g. roads and power distribution) and ∼ EUR 3–4 billion in insured losses (Kendon, 2022; Saville, 2022). These losses illustrate the importance of considering multi-hazard risk (Kappes et al., 2012; Ward et al., 2022; Zscheischler et al., 2018). In northwest Europe, flooding and extreme wind cause the largest losses (Mitchell-Wallace et al., 2017), co-occurring on timescales from sub-daily to seasonal (Bloomfield et al., 2023; De Luca et al., 2017; Hillier and Dixon, 2020; Owen et al., 2021a, b). This dependency exists in meteorological variables, such as precipitation (e.g. Martius et al., 2016), and in impact data, which includes insurance losses and railway delays (Hillier et al., 2015, 2020). Yet, the potential for this multi-hazard relationship is not always considered in (re)insurance risk analysis. Like almost all hazards, European flooding and wind risk are currently modelled separately by catastrophe models (Mitchell-Wallace et al., 2017). Tropical cyclones are the recent exception, with hazards derived from the same climate model (Stalhandske et al., 2024; Verrisk, 2024).

Prior to such a full joint modelling workflow, this paper proposes and evaluates a statistical approach to combining flooding and wind risk models using their per-event hazard values and losses they output. These are small and obtainable datasets. It is the first open-access code for this task, intended for use by any researcher or practitioner. The approach was developed during a collaborative project, TOGETHER (contributed to by the Bank of England, Verrisk, Aon, Met Office and Loughborough University), which led to a modification to the insurance stress tests that regulate UK insurers (Bank of England, 2022).

The research questions are as follows:

-

What is the impact of co-occurring wet and windy weather in the UK on insurers' joint annual 1-in-200-year financial risk?

-

How useful is the proposed approach in translating scientific research into insurance industry practice?

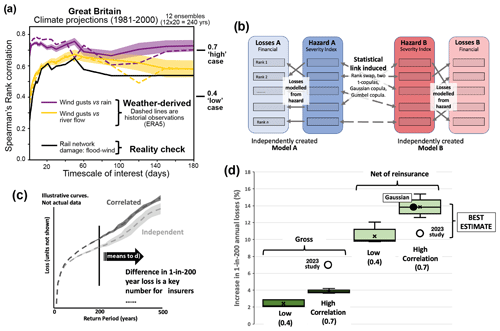

The innovation is that our approach uses climate science to link risk models via severity indices (SI) recording the magnitude of each hazard, such as ∑v3 for wind (Bloomfield et al., 2023; Klawa and Ulbrich, 2003; Nordhaus, 2010). High and low inter-hazard correlation cases derived from a climate model (Fig. 1a) are applied to SI values available within risk models (Fig. 1b) from the reinsurance industry without exposing commercial sensitive data.

Figure 1Pathway from hazard to impact, i.e. effect on losses for very severe events. (a) Wintertime correlation (Spearman's rank, rs) within various multi-hazard episode durations for the October–March season using severity indices for flooding and extreme wind in Great Britain (Bloomfield et al., 2023). Rain (purple) and river flow (yellow) are related to wind hazard for climate model (UKCP; solid lines) and historical (ERA5; dashed lines) data. Error bands are 95 % confidence intervals. (b) Illustration of the method, i.e. statistically linking two independent risk models (red and blue) via their hazard severity indices. (c) Illustrative exceedance probability curves for correlated (dark grey) and independent (light grey) cases, the difference between which is the effect of co-occurrence, with the 1-in-200 return period (RP; p=0.005) being of particular interest in insurance. (d) Indicative impact of a correlation between flooding and wind hazards on annual losses for the whole UK market at a 1-in-200-year return period. Box plots illustrate the range of answers generated by the five different types of correlation (see panel b) for each of the four cases analysed: low-gross, high-gross, low-net and high-net. As in Hillier et al. (2023), the Gaussian case is the “best” and highlighted (black dot) as it best fits annualised hazard data at Site W of Hillier and Dixon (2020). Open circles are from that 2023 study, which used two different catastrophe models.

Correlation is applied at a seasonal timescale because the annual 1-in-200-year return period (RP) loss after reinsurance (i.e. net of insurance companies' own insurance) is a key metric used to calculate insurers' solvency (Hadzilicos et al., 2021). Four statistical methods (e.g. copula) are used, exactly as in Hillier et al. (2023). The calculations are detailed in the R code provided (see the Supplement). The only inputs needed are a three-column text file for each model (date, SI and monetary loss), with one row dedicated to each event. No changes to the R code are needed to apply it to other regions of the world or hazard pairs, assuming a correlation coefficient can be determined for the user's data of choice (reanalysis, climate model or emissions pathway).

We use data from two independently derived catastrophe risk models available from Aon. A time series of 4731 years is used, with fluvial flood events that have non-zero losses in the UK more frequently (∼7 per year) than wind events (∼3 per year), and UK-aggregated event losses are approximately log-normal with tail-end wind losses (RP >100 years) approximately twice those of flood. For wind, correlation ρ between SI (∑v3) and loss per year is in the range of ∼0.5–0.8 and about half of this for flooding (ρ∼0.2–0.3; SI is number of events). To test-run the R code, events derived from the UK Climate Projection (UKCP) (Bloomfield et al., 2023; Griffin et al., 2024) have been created to approximate this configuration but are illustrative only, and these outputs should not be interpreted.

To understand the utility of this approach in translating scientific research into reinsurance industry practice, statements were elicited from TOGETHER's collaborators. These data are in the Supplement, referenced by company name(s) for quotes or syntheses. Illustratively, the following is a quote found in the Supplement:

This statement is a means for Bank of England staff to share views that challenge – or support – prevailing policy orthodoxies. The views expressed here are those of the authors, and are not necessarily those of the Bank of England or its policy committees. (Bank)

Figure 1d shows the estimated effect that flood–wind co-occurrence has on the annual 1-in-200-year financial risk, reporting the difference between the typical assumption (i.e. independence) and a correlated case. As in the Bank of England report (Hillier et al., 2023), the high-correlation Gaussian copula case is considered most realistic and net of reinsurance (i.e. “after”; in light green) the most relevant. Lower gross yet higher net losses are mainly caused by the flood hazard metric available. The principal result, visually synthesising results from the studies, is that uplift might be as high as ∼10 %–14 % for the very specific scenario analysed. It is vital to realise, however, that this result should not be over-interpreted and specifically should not be taken to necessarily indicate “under-capitalisation of any particular firm nor of the sector in general” (Aon).

Quantifying tail risk, i.e. severe but rare circumstances, is desirable for a general insurer's risk management. There are potential benefits in shared effort in addressing this complex task, yet there is simultaneously the potential for commercial tensions that stem from organisations' differing roles (e.g. insurer, broker or regulator), analogous to many global industries (Ritala, 2012). Such beneficial cooperation between organisations potentially in competition has been labelled “co-opetition” in paradox studies (Brandenburger and Nalebuff, 1996; Gnyawali and He, 2008; Smith et al., 2017). Various ways of handling this exist (e.g. Stadtler and Van Wassenhove, 2016), although a critical part can be succinctly summarised as follows: “Partnerships require good networks, time, and trust to develop” (Met Office). TOGETHER is seen as a successful example of a co-opetition project (Hillier and Van Meeteren, 2024). The finding that co-occurrence might plausibly raise annual joint UK flood–wind net losses of reinsurance by up to ∼10 % (Fig. 1d) is only applicable in this particular analysis, but as an indicator that correlated hazards are worth considering, it is seen as a valuable contribution (Aon, Met Office, Bank). Developing the open-source R code tool is also considered a benefit:

An important step in bringing together publicly funded climate model data and industry-based modelling in a transparent way. (Aon)

But to what extent is it useful? It is a valuable first step (Aon), which can be an informative tool for those insurers who have not previously captured these dependencies because it is prudent to explore rather than ignore potential dependencies (Bank) (Hillier et al., 2023). The approach can be applied to any sets of events (e.g. hail and wildfire) from existing models (Aon), making it quickly implementable. However, whilst it accounts for uncertainty in one key choice (i.e. dependency structure), there are many other variables, such as the reinsurance structure or risk model used. Hence, critically, careful interpretive judgement is needed:

Where tools such as this R code are applied to inform a view of risk, caveats and assumptions should be considered; users should be satisfied a tool is being used in appropriate circumstances. (Bank)

Illustratively, it would be unwise to apply the headline result to an insurer's unique portfolio. For this reason, being open-source and transparent is highlighted as the key benefits of the proposed approach (Aon, Met Office). Possible applications include exploring the sensitivity of peril co-occurrence to different financial structures (e.g. number of reinstatements) (Bank). As an independent and open-source tool, it also provides a means to benchmark future similar work in this field (Aon) and can be applied to different hazards.

Overall, we conclude that our approach is one useful interim solution prior to, and perhaps justifying, more extensive modelling. It is a bridge, deploying a metric (inter-hazard correlation coefficient) obtainable from scientific research, which is usable in practice without restricted data being exposed. More generally, it is an example of embedding environmental science into practice and policy by identifying a simple pragmatic means (i.e. r) of estimating the impact on a critical industry-relevant metric. It paves the way for similar methods to be applied within other sectors (e.g. rail, road, power distribution and telecommunications), perhaps for physical climate risk disclosure.

The R code used is openly available and is in the Supplement to this article along with guidance and a worked example with idealised data. Data from the proprietary insurance sector models used are not available.

The supplement related to this article is available online at: https://doi.org/10.5194/gc-7-195-2024-supplement.

JH conceived the work and undertook the analysis. All authors contributed to the drafting, writing and review of the paper.

At least one of the (co-)authors is a member of the editorial board of Geoscience Communication. The peer-review process was guided by an independent editor, and the authors also have no other competing interests to declare.

Ethical approval was given by the Ethics Review Sub-Committee at Loughborough University.

Publisher's note: Copernicus Publications remains neutral with regard to jurisdictional claims made in the text, published maps, institutional affiliations, or any other geographical representation in this paper. While Copernicus Publications makes every effort to include appropriate place names, the final responsibility lies with the authors.

This article is part of the special issue “Methodological innovations for the analysis and management of compound risk and multi-risk, including climate-related and geophysical hazards (NHESS/ESD/ESSD/GC/HESS inter-journal SI)”. It is not associated with a conference.

John Hillier was funded by NERC (UKRI) knowledge exchange fellowships, and Hannah Bloomfield by the GCFI project. We are grateful to Aon, Bank of England and the Met Office for their collaboration.

This research has been supported by UK Research and Innovation (grant nos. NE/R014361/1, NE/V018698/1, and NE/V017756/1).

This paper was edited by Shahzad Gani and reviewed by two anonymous referees.

Bank of England: General Insurance Stress Test 2022, https://www.bankofengland.co.uk/prudential-regulation/letter/2022/january/insurance-stress-test-2022-request-for-technical-input (last access: 5 April 2022), 2022.

Berghuijs, W. R., Harrigan, S., Molnar, P., Slater, L., and Kirchner, J. W.: The relative importance of different flood-generating mechanisms across Europe, Water Resour. Res., 55, 4582–4593, https://doi.org/10.1029/2019WR024841, 2019.

Bloomfield, H., Hillier, J. K., Griffin, A., Kay, A. L., Shaffrey, L., Pianosi, F., James, R., Kumar, D., Champion, A. J., and Bates, P. D.: Co-occurring wintertime flooding and extreme wind over Europe, from daily to seasonal timescales, Weather Clim. Extremes, 39, 100550, https://doi.org/10.1016/j.wace.2023.100550, 2023.

Brandenburger, A. and Nalebuff, B.: Co-opetition, Doubleday, New York, 290 pp., 1996.

Cordner, A.: Strategic Science Translation and Environmental Controversies, Sci. Technol. Hum. Val., 40, 915–938, https://doi.org/10.1177/0162243915584164, 2015.

De Luca, P., Hillier, J. K., Wilby, R. L., Quinn, N. W., and Harrigan, S.: Extreme multi-basin flooding linked with extra-tropical cyclones, Environ. Res. Lett., 12, 114009, https://doi.org/10.3390/atmos10100577, 2017.

Dowling, D. A.: The Dowling Review of Business-University Research Collaborations, 85 pp., 2015.

Evans, J.: Lost in translation? Exploring the interface between local environmental research and policymaking, Environ. Plann. A, 38, 517–531, https://doi.org/10.1068/a37393, 2006.

Finney, M. A., McHugh, C. W., Grenfell, I. C., Riley, K. L., and Short, K. C.: A simulation of probabilistic wildfire risk components for the continental United States, Stoch. Env. Res. Risk A., 25, 973–1000, 2011.

Gnyawali, D. R. and He, J.: Co-opetition: Promises and challenges, in: 21st century management: A reference handbook, edited by: Wankel, C., Sage, Thousand Oaks, CA, 386–398, 2008.

Griffin, A., Kay, A. L., Sayers, P., Bell, V., Stewart, E., and Carr, S.: Widespread flooding dynamics under climate change: characterising floods using grid-based hydrological modelling and regional climate projections, Hydrol. Earth Syst. Sci., 28, 2635–2650, https://doi.org/10.5194/hess-28-2635-2024, 2024.

Hadzilicos, G., Li, R., Harrington, P., Latchman, S., Hillier, J. K., Dixon, R., New, C., Alabaster, A., and Tsapko, T.: It's windy when it's wet: why UK insurers may need to reassess their modelling assumptions, Bank Underground, 2021.

Hillier, J. K. and Dixon, R.: Seasonal impact-based mapping of compound hazards, Environ. Res. Lett., 15, 114013, https://doi.org/10.1088/1748-9326/abbc3d, 2020.

Hillier, J. K. and van Meeteren, M.: Co-RISK: a tool to co-create impactful university–industry projects for natural hazard risk mitigation, Geosci. Commun., 7, 35–56, https://doi.org/10.5194/gc-7-35-2024, 2024.

Hillier, J. K., Macdonald, N., Leckebusch, G. C., and Stavrinides, A.: Interactions between apparently primary weather-driven hazards and their cost, Environ. Res. Lett., 10, 104003, https://doi.org/10.1088/1748-9326/10/10/104003, 2015.

Hillier, J. K., Matthews, T., Wilby, R. L., and Murphy, C.: Multi-hazard dependencies can increase and decrease risk, Nat. Clim. Change, 10, 595–598, https://doi.org/10.1038/s41558-020-0832-y, 2020.

Hillier, J. K., Perkins, T., Li, R., Bloomfield, H., Lau, J., Claus, S., Harrington, P., Latchman, S., and Humphry, D.: What if it's a perfect storm? Stronger evidence that insurers should account for co-occurring weather hazards, Bank Underground, 2023.

Kappes, M. S., Keiler, M., von Elverfeldt, K., and Glade, T.: Challenges of analyzing mulit-hazard risk: a review, Nat. Hazards, 64, 1925–1958, https://doi.org/10.1007/s11069-012-0294-2, 2012.

Kendon, M.: Storms Dudley, Eunice and Franklin February 2022, Technical Report. Met Office, 2022.

Klawa, M. and Ulbrich, U.: A model for the estimation of storm losses and the identification of severe winter storms in Germany, Nat. Hazards Earth Syst. Sci., 3, 725–732, https://doi.org/10.5194/nhess-3-725-2003, 2003.

Margalida, A., Kuiken, T., and Green, R. E.: Improving the Translation from Science to Environmental Policy Decisions, Environ. Sci. Technol., 49, 2600–2600, https://doi.org/10.1021/acs.est.5b00145, 2015.

Martius, O., Pfahl, S., and Chevalier, C.: A global quantification of compound precipitation and wind extremes: Compound precipitation and wind extremes, Geophys. Res. Lett., 43, 7709–7714, https://doi.org/10.1002/2016GL070017, 2016.

Mitchell-Wallace, K., Jones, M., Hillier, J. K., and Foote, M.: Natural Catastrophe Risk Management and Modelling: A Practitioner's Guide, Wiley, Oxford, UK, 506 pp., 2017.

Mühr, B., Eisenstein, L., Pinto, G. J., Knippertz, P., Mohr, S., and Kunz, M.: Winter storm series: Ylenia, Zeynep, Antonia (int: Dudley, Eunice, Franklin) February 2022 (NW & Central Europe), KIT, 2022.

Nordhaus, W.: The economics of hurricanes and implications of global warming, Clim. Change Econ., 1, 1–20, https://doi.org/10.1142/S2010007810000054, 2010.

Owen, L. E., Catto, J. L., Dunstone, N. J., and Stephenson, D. S.: How well can a seasonal forecast system represent three hourly compound wind and precipitation extremes over europe?, Environ. Res. Lett., 16, 074019, https://doi.org/10.1088/1748-9326/ac092e, 2021a.

Owen, L. E., Catto, J. L., Stephenson, D. S., and Dunstone, N. J.: Compound precipitation and wind extremes over europe and their relationship to extratropical cyclones, Weather Clim. Extremes, 33, 100342, https://doi.org/10.1016/j.wace.2021.100342, 2021b.

Ritala, P.: Coopetition strategy – When is it successful? Empirical evidence on innovation and market performance, British Journal of Management, 23, 307–324, 2012.

Saville, G.: A stormy end to winter: Loss estimates and storm science, WTW Insights, https://www.wtwco.com/en-gb/insights/2022/03/a-stormy-end-to-winter-loss-estimates-and-storm-science (last access: 1 August 2023), 2022.

Scott, A., Carter, C., Hardman, M., Grayson, N., and Slayney, T.: Mainstreaming ecosystem science in spatial planning practice: Exploiting a hybrid opportunity space, Land Use Policy, 70, 232–246, https://doi.org/10.1016/j.landusepol.2017.10.002, 2018.

Smith, W. K., Lewis, M. W., Jarzabkowski, P., and Langley, A. (Eds.): The Oxford Handbook of Organizational Paradox, Oxford University Press, 622 pp., 2017.

Stadtler, L. and Van Wassenhove, L. N.: Coopetition as a Paradox: Integrative Approaches in a Multi-Company, Cross-Sector Partnership, Organization Studies, 37, 655–685, https://doi.org/10.1177/0170840615622066, 2016.

Stalhandske, Z., Steinmann, C. B., Meiler, S., Sauer, I. J., Vogt, T., Bresch, D. N., and Kropf, C. M.: Global multi-hazard risk assessment in a changing climate, Sci. Rep., 14, 5875, https://doi.org/10.1038/s41598-024-55775-2, 2024.

Verrisk: Extreme Event Risk: Tropical Cyclone Risk Models https://www.verisk.com/en-gb/products/tropical-cyclone-models/, last access: 20 June 2024.

Volonté, A., Gray, S. L., Clark, P. A., Martínez-Alvarado, O., and Ackerley, D.: Strong surface winds in Storm Eunice. Part 1: storm overview and indications of sting jet activity from observations and model data, Weather, 79, 40–45, https://doi.org/10.1002/wea.4402, 2024a.

Volonté, A., Gray, S. L., Clark, P. A., Martínez-Alvarado, O., and Ackerley, D.: Strong surface winds in Storm Eunice. Part 2: airstream analysis, Weather, 79, 54–59, https://doi.org/10.1002/wea.4401, 2024b.

Ward, P. J., Daniell, J., Duncan, M., Dunne, A., Hananel, C., Hochrainer-Stigler, S., Tijssen, A., Torresan, S., Ciurean, R., Gill, J. C., Sillmann, J., Couasnon, A., Koks, E., Padrón-Fumero, N., Tatman, S., Tronstad Lund, M., Adesiyun, A., Aerts, J. C. J. H., Alabaster, A., Bulder, B., Campillo Torres, C., Critto, A., Hernández-Martín, R., Machado, M., Mysiak, J., Orth, R., Palomino Antolín, I., Petrescu, E.-C., Reichstein, M., Tiggeloven, T., Van Loon, A. F., Vuong Pham, H., and de Ruiter, M. C.: Invited perspectives: A research agenda towards disaster risk management pathways in multi-(hazard-)risk assessment, Nat. Hazards Earth Syst. Sci., 22, 1487–1497, https://doi.org/10.5194/nhess-22-1487-2022, 2022.

Zscheischler, J., Westra, S., van der Hurk, B. J. J. M., Seneviratne, S. I., Ward, P. J., Pitman, A., AghaKouchak, A., Bresch, D. N., Leonard, M., Wahl, T., and Zhang, X.: Future climate risk from compound events, Nat. Clim. Change, 8, 469–477, https://doi.org/10.1038/s41558-018-0156-3, 2018.

- Abstract

- Copyright statement

- Introduction

- Methods and data

- Quantitative results

- Discussion and reflections

- Code and data availability

- Author contributions

- Competing interests

- Ethical statement

- Disclaimer

- Special issue statement

- Acknowledgements

- Financial support

- Review statement

- References

- Supplement

- Abstract

- Copyright statement

- Introduction

- Methods and data

- Quantitative results

- Discussion and reflections

- Code and data availability

- Author contributions

- Competing interests

- Ethical statement

- Disclaimer

- Special issue statement

- Acknowledgements

- Financial support

- Review statement

- References

- Supplement